For years, the gospel of startup funding has preached equity above all else. Raise venture capital, give up a slice of your company, and fuel your growth. Debt, if it came up at all, was often seen as a last resort, a sign of distress, or a tool for mature companies. But new research is flipping that script, revealing significant startup debt benefits that could fundamentally reshape how early-stage companies finance their ambitions.

A joint study by fintech re:cap and equity management platform Eqvista, analyzing over 10,000 data points from 530 early-stage startups, paints a compelling picture. Companies that strategically leverage debt financing aren't just surviving; they're thriving, achieving faster revenue growth and substantially higher valuations compared to their equity-only peers. The findings, released today, suggest that debt is not just an alternative, but a powerful, underutilized growth lever.

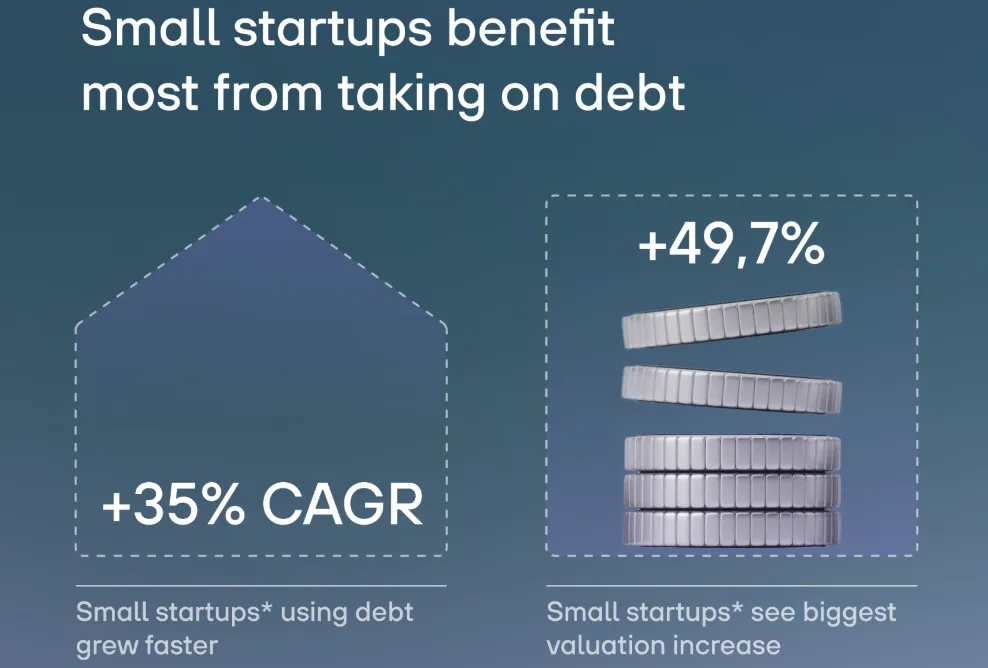

The numbers are stark. Startups incorporating debt into their capital stack saw valuation uplifts of up to 49.7%. This wasn't just for established players; smaller, early-stage companies with revenues between $100,000 and $1 million benefited most, experiencing both accelerated growth (35% CAGR vs. 34.2% overall) and the largest valuation boost. As companies scale, debt adoption increases, rising from 24% in the $100K-$1M bracket to 36% for those earning $5M-$10M, reflecting growing lender confidence and strategic founder choices.

Paul Becker, CEO and co-founder of re:cap, frames it clearly: “Debt for startups is a strategic opportunity; when managed with foresight, it can unlock growth, preserve equity, and signal discipline to investors.” He argues that debt should be a "core component of a diversified capital stack," not merely a fallback. This perspective challenges the long-held notion that founders must dilute their ownership at every growth stage.

The Strategic Shift in Startup Funding

The core of these startup debt benefits lies in preserving equity. For founders, every equity round means giving up a piece of their company. Debt, when used judiciously, allows them to inject capital for growth without further dilution, especially when market conditions for equity are unfavorable or when they're on the cusp of a major milestone. This strategic timing can significantly impact a company's long-term value and a founder's control.

Sophie Chung, founder and CEO of Qunomedical, exemplifies this shift. She explained her decision to raise debt: “Raising equity now wouldn’t be a smart move given our near break-even point and the expected surge in growth. We need to demonstrate traction once more and enter the next fundraising round from a position of strength. Additional dilution at this stage would only be detrimental.” Her experience underscores a growing sentiment: debt is a tool for empowerment, allowing founders to dictate the terms and timing of their equity rounds.

This isn't just about avoiding dilution; it's about signaling maturity and financial discipline. Companies capable of securing and managing debt often present a more robust financial profile to future equity investors, potentially improving negotiation power and securing better terms. The increasing variety of debt providers for startups further expands access, making these startup debt benefits accessible to a broader range of early-stage ventures.

The takeaway for the tech industry is clear: the traditional equity-first dogma is evolving. Founders, armed with data and a wider array of financing options, are now strategically integrating debt to optimize their capital structure, accelerate growth, and ultimately, build more valuable companies while retaining greater control. The conversation around startup funding is no longer binary; it's about a sophisticated blend of capital that maximizes both growth and ownership.