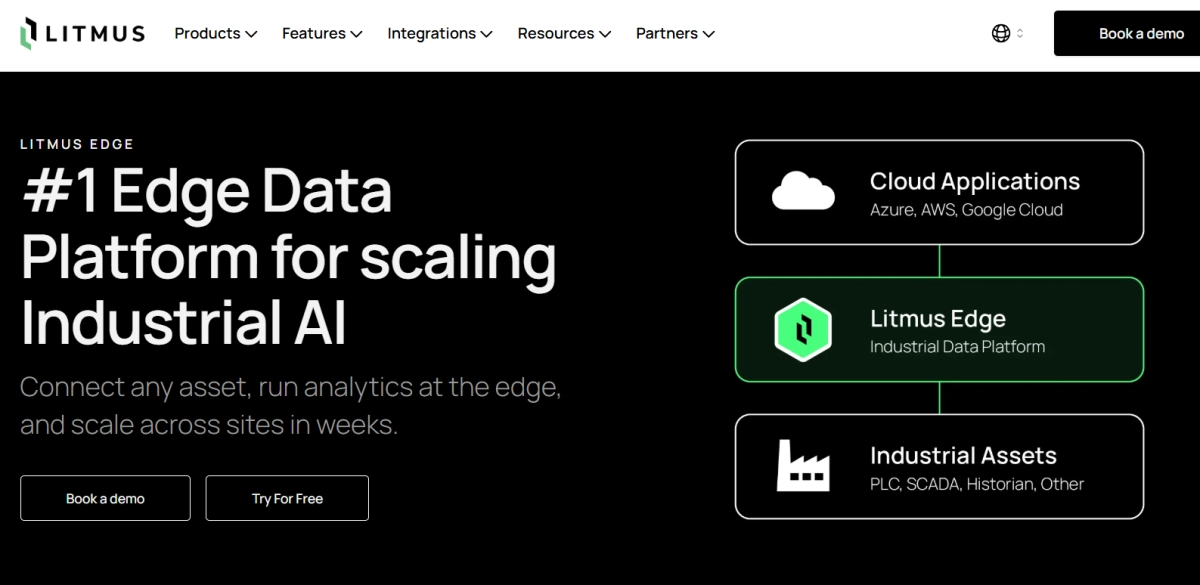

The industrial sector is the next great frontier for artificial intelligence, but the promise of optimization and predictive maintenance remains bottlenecked by a fundamental problem: fragmented, inaccessible machine data. Litmus, a key player in bridging this operational technology (OT) and information technology (IT) divide, just secured a fresh round of strategic funding led by Insight Partners and Munich Re Ventures (via HSB Fund II) to accelerate its Industrial Edge Data Platform.

This Litmus funding isn’t just capital; it’s a validation of the painful complexity inherent in modern manufacturing. While every major cloud provider is pushing AI tools, those tools are useless if they can’t speak the language of the factory floor. Litmus specializes in translating raw machine signals—the messy data streams from thousands of disparate sensors and legacy systems—into governed, contextualized, and AI-ready data.

“Litmus is addressing one of the hardest challenges in modern manufacturing—enabling Industrial AI on fragmented data,” noted Josh Fredberg, Managing Director at Insight Partners.

The company’s core strength lies in its connectivity. Litmus boasts over 250 out-of-the-box connectors, giving it arguably the broadest native OT connectivity in the industry. This capability allows global manufacturers to centralize data management and scale operations rapidly, moving from managing data in one factory to five or more within weeks—a speed benchmark that is critical for enterprise-wide digital transformation.

The platform has become the data foundation for some of the world’s largest manufacturers, and its ecosystem validation is robust. Its long-standing collaborations with Microsoft Azure, Google Cloud, and AWS expanded significantly in 2025 with new partnerships with Oracle Cloud and Databricks, cementing Litmus’s position as a crucial middleware layer between the edge and the cloud AI infrastructure.

### The Edge Data Wars Accelerate

The new Litmus funding will be strategically deployed to deepen the platform’s capabilities across three critical areas, all centered on accelerating the time-to-value for industrial AI models.

First, the company is investing heavily in **AI at the edge**. This involves deploying intelligent agents directly onto factory hardware to boost yield, minimize losses, and accelerate decision-making locally, without relying on constant cloud connectivity. This is essential for high-speed processes where latency is unacceptable.

Second, the capital will optimize **AI in deployment**. Manufacturers struggle not just with building models, but with scaling them across thousands of machines and multiple global sites. Litmus plans to cut time-to-value by optimizing data pipelines, making it easier for manufacturers to deploy and scale AI models faster across disparate sites.

Finally, the focus is on **AI in experience**. This means making the data collected and managed by Litmus systems easier to interact with. New features and interfaces will allow users—from plant managers to data scientists—to query and leverage the contextualized data without needing deep IT expertise.

The involvement of Munich Re Ventures, through HSB Fund II, highlights a fascinating adjacent market: risk management. As Stephanie Watkins, SVP of HSB’s Global Insurance Innovation Group, explained, real-time industrial data can transform risk assessment, enabling proactive equipment health monitoring and predictive maintenance insights that benefit both manufacturers and their insurers. This suggests that the value of contextualized machine data extends far beyond simple operational efficiency and into the realm of financial risk mitigation.

Litmus’s recent recognition as a Challenger in the 2025 Gartner Magic Quadrant for Global Industrial IoT Platforms underscores its growing market influence. But the company’s CEO, Vatsal Shah, is clear about the competitive edge this funding provides.

“Contextualized industrial data is the fuel for AI, and Litmus is the only platform built to make it enterprise-ready at scale,” Shah said. “No one else can bridge OT and IT data, centralize management, and scale across multiple factories as fast as we can. This funding allows us to double down on innovation and deliver that competitive edge to every customer worldwide.”

The reality is that while the AI race is often framed around large language models and consumer applications, the true economic transformation will happen on the factory floor. The new Litmus funding ensures that the company remains at the forefront of solving the foundational data access challenges required to make that transformation possible.