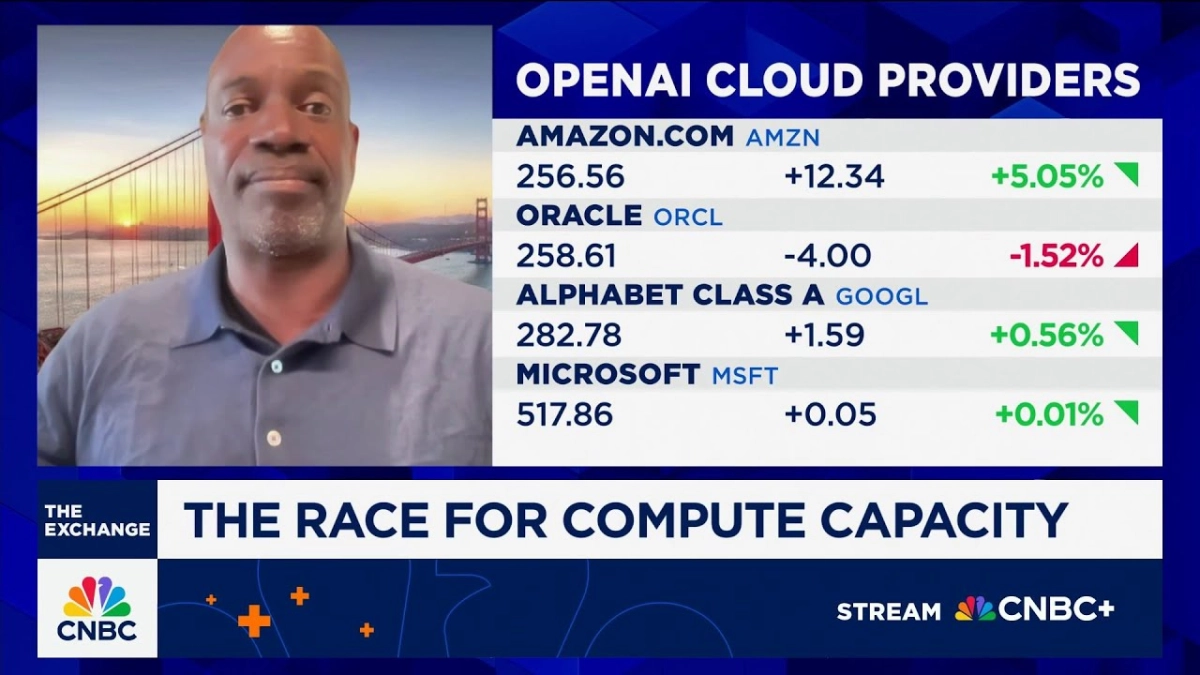

"The intent is clearly now to identify ways to control the entire vertical stack of AI along with this horizontal diversification of cloud," articulated Lo Toney, Founding Managing Partner at Plexo Capital, during a recent discussion on CNBC's 'The Exchange'. Toney's commentary, delivered to interviewer Melissa Lee, dissected OpenAI's latest strategic moves, particularly its broadened cloud partnerships beyond Microsoft Azure to include AWS, Oracle, and Google Cloud, following the expiration of Microsoft's exclusive right of first refusal. The conversation illuminated OpenAI's maturing corporate strategy, aiming for greater leverage and resilience in the rapidly evolving artificial intelligence landscape.

This diversification is not merely about spreading workloads; it is a calculated maneuver to mitigate concentration risk, a critical factor in an industry heavily reliant on immense compute capacity. By distributing its demands across multiple major cloud providers, OpenAI gains significant leverage over pricing, capacity allocation, and geographic deployment, transforming its operational flexibility. This strategic pivot underscores a deeper ambition: to establish a robust, vertically integrated, and now horizontally diversified industrial platform for AI.

Toney frames this shift not as a sign of an impending AI bubble, but rather as a robust "boom." He argues that the AWS/OpenAI deal tilts decidedly towards a boom, representing a diversification for resilience, rather than speculative expansion. The underlying demand for compute, identified by Sam Altman as the real constraint in AI development, fuels this infrastructure build-out. This is a fundamental re-evaluation of AI's role, positioning it as the new industrial base of the global economy, where compute, energy, and data emerge as strategic resources akin to oil or steel in previous industrial revolutions.

The broader implications extend beyond OpenAI. For Microsoft, while still a primary investor and supplier, the loss of exclusivity means a dilution of its unique position, though its core partnership remains intact. Other cloud providers, now partners, face both opportunities and risks, as OpenAI's growing influence could reshape their own strategic priorities. The move indicates that OpenAI is adopting an "Apple playbook," aiming to own and control the entire vertical stack, from the foundational chip layer to data centers and eventually the application layer. This strategy is designed to increase control and, crucially, to enhance margins by capturing value across multiple tiers of the AI ecosystem.

As OpenAI expands its infrastructure, exemplified by initiatives like Oracle's Stargate data centers requiring massive investments in energy and silicon, the scale of capital required becomes astronomical. These colossal financial demands, potentially well over a trillion dollars for data center build-out, will eventually exhaust the pool of deep-pocketed private investors. Toney anticipates that this will inevitably lead OpenAI to transition from a private entity to a public company.

Such a public offering, he posits, could redefine market expectations, becoming "the biggest IPO that we will have ever seen." This eventual public listing would not only provide the necessary capital injection but also democratize ownership, aligning with Sam Altman's stated excitement for the public to have access to OpenAI shares. The current phase, marked by strategic partnerships and vertical integration, is a preparatory stage, readying the company for the immense demand and application development expected to unfold.