In the relentless pursuit of artificial intelligence, the spotlight often falls on the computational titans, the GPUs that power the inferential engines. Yet, as Jim Cramer elucidated on CNBC's *Mad Money*, the true bedrock of this technological revolution lies not just in processing power, but in the often-underappreciated realm of memory and storage. Cramer’s recent commentary highlighted Micron Technology, a company he champions, as a prime example of a semiconductor firm finally receiving due recognition for its pivotal role in the burgeoning AI data center boom.

Jim Cramer, speaking on *Mad Money*, discussed Micron's recent stock performance and its connection to the massive growth in AI infrastructure. He framed Micron's trajectory as a significant evolution, moving beyond its historical perception as a mere commodity chipmaker to a critical enabler of advanced computing. The conversation centered on Micron's latest earnings report and the curious market reaction to what were, by all accounts, exceptionally strong financial results.

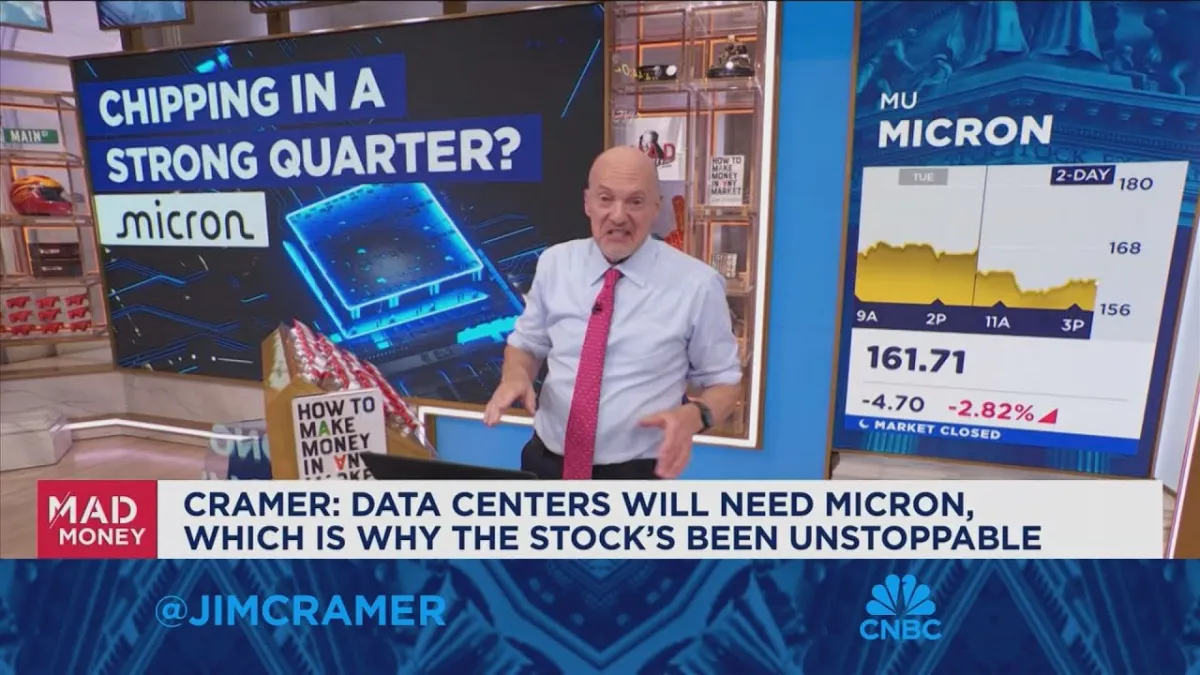

Micron, trading under the ticker MU, has demonstrated an "unstoppable" ascent in recent months, with its stock climbing 170% from its April lows, including a staggering 40% gain since the end of August. This remarkable rally, Cramer argues, is a direct consequence of the escalating demand for high-bandwidth memory (HBM) and storage solutions, indispensable components for the vast server farms powering AI applications. "Everybody talks about Nvidia and so many of the data center infrastructure plays," Cramer noted, acknowledging their deserved recognition. However, he quickly pivoted to emphasize that "these are big warehouses full of servers, and those servers need storage, they need memory, especially high-bandwidth memory... to keep everything running smoothly." This insight underscores a fundamental truth: AI's insatiable hunger for data processing requires equally robust and rapid data access, a domain where Micron excels.

Despite this impressive backdrop and the strategic importance of its products, Micron's shares experienced a dip on the day of Cramer's broadcast, shedding nearly 3% following its fiscal fourth-quarter earnings report. This market reaction might seem counterintuitive, given the company's stellar performance. Micron reported total revenue of $11.32 billion, a remarkable 46% increase year-over-year, significantly surpassing Wall Street's estimate of $10.75 billion. Non-GAAP earnings per share (EPS) came in at $3.03, comfortably beating the $2.55 consensus. Furthermore, the company’s non-GAAP gross margin soared to 45.7%, an increase of over 900 basis points from the previous year, with non-GAAP operating income reaching $3.96 billion, reflecting a staggering 1250 basis point improvement.

These figures represent more than just a beat; they signify a profound turnaround and an accelerating trajectory for Micron. Cramer, in his characteristic style, passionately declared, "The numbers were like stellar! Micron's revenue was up 46% year-over-year, almost 22% from the previous quarter... Their gross margin came in just under 46%, which was up over 900 basis points from the year before. That's almost impossible to do." He highlighted the company's ability to not only exceed expectations but to demonstrate a dramatic quarter-over-quarter improvement in profitability and revenue growth, suggesting a robust underlying business model.

The apparent paradox of strong earnings met with a stock decline can be attributed to the "great expectations" phenomenon that often shadows high-growth sectors, particularly in AI. Investors, having driven Micron's stock to significant highs in anticipation of strong results, often demand perfection and even more aggressive forward guidance. When a company delivers excellent but not *superlative* enough results against an already inflated expectation, a temporary pullback can occur. This dynamic presents a critical insight for founders and VCs: market sentiment, especially in speculative bubbles, can temporarily overshadow fundamental value, but the underlying business strength is what truly sustains long-term growth.

The strategic importance of high-bandwidth memory (HBM) for AI cannot be overstated. Unlike traditional DRAM, HBM stacks multiple memory dies vertically, integrating them directly onto the same interposer as the GPU. This architecture dramatically increases bandwidth and reduces latency, allowing AI accelerators to feed data to their processing units at unprecedented speeds. Without HBM, even the most powerful GPUs would be starved of data, bottlenecking the performance of large language models and other complex AI workloads. Micron's advancements in HBM technology are therefore not merely incremental improvements but foundational enablers for the next generation of AI.

Micron’s robust financial performance and strategic positioning in the HBM market signal a durable shift in its value proposition.

For startup ecosystem leaders, defense/AI analysts, and tech insiders, Micron's story serves as a potent reminder that the AI revolution is a full-stack endeavor. While AI software and models capture headlines, the underlying hardware—particularly specialized memory solutions like HBM—is just as critical, if not more so, for unlocking scalable performance. Investing in or building companies that address these foundational infrastructure needs, even if they appear less glamorous than the latest AI applications, could yield substantial long-term returns. Cramer’s advice to "ignore the trading" and focus on the "stellar" numbers is a call to look beyond short-term market fluctuations and recognize the enduring value of companies that provide indispensable components for transformative technologies. Micron's journey from a perceived commodity provider to a vital AI enabler illustrates the profound shifts occurring across the semiconductor landscape.