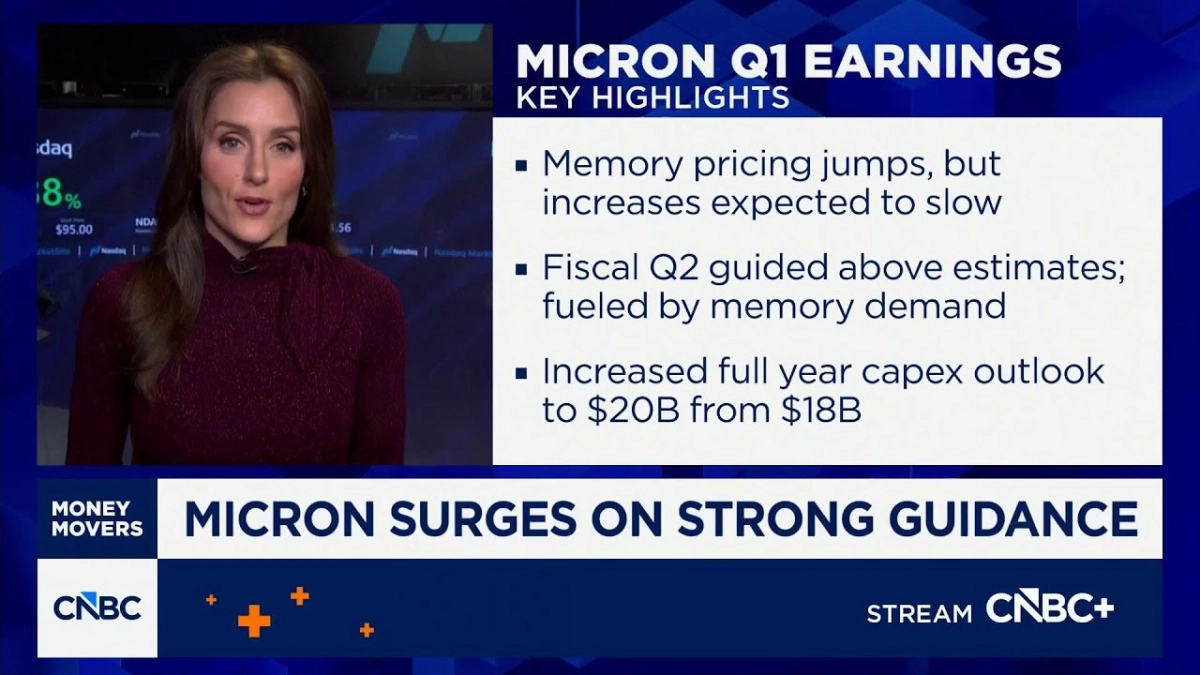

CNBC’s Kristina Partsinevelos, reporting on "Micron's Margin Boom" during a "Money Movers" segment, detailed how Micron’s advanced memory production for AI is completely sold out through 2026, driving memory pricing up by a dramatic 20% quarter-over-quarter, with storage chips also seeing mid-teen increases. This acute supply tightness, she noted, is the primary catalyst for the stock's dramatic ascent and the company’s robust guidance. The CFO expects margins and overall performance to continue improving through fiscal 2026, painting a bullish picture for the immediate future of memory providers.

However, the memory market has always been cyclical, a point Partsinevelos underscored by reminding viewers that "prices surge during shortages and then crash when supply catches up." While the current landscape favors Micron, with its 70% gross margins, the long-term sustainability of such high valuations remains a critical consideration for investors. The CFO’s tempered expectation that the rate of pricing increases will slow beyond February suggests an acknowledgment of this inherent cyclicality, hinting that the current stratospheric growth might normalize as supply eventually begins to catch up, or as demand elasticity comes into play.

The true impact of Micron's margin boom extends far beyond its balance sheet, rippling through the entire technology ecosystem. The question of "who's paying for Micron's near 70% gross margins" is central to understanding the broader market shifts. Hyperscalers like Amazon, Microsoft, and Google, who are aggressively building out AI data centers, are directly absorbing these higher memory costs. This translates into increased capital expenditure for these tech giants, potentially influencing their own profitability and the pace of their AI deployments.

Server makers are also feeling the pinch and are actively passing these costs along. Hewlett Packard Enterprise (HPE) reportedly raised server prices by 15% in November, with Dell Technologies following suit this month with a roughly 15-20% increase. This direct pass-through means that the higher cost of AI memory chips ultimately translates into more expensive hardware for enterprises and, eventually, for consumers. It is a fundamental economic shift where the foundational components of the AI revolution are dictating pricing across a wide array of end products.

Even companies like Broadcom, which integrate memory into their broader semiconductor offerings, are experiencing margin compression. Partsinevelos highlighted that memory costs contributed to roughly 100 basis points of pressure on Broadcom’s gross margins, which in turn played a role in an 11% post-earnings sell-off for the company. This illustrates how the rising tide of memory costs, while lifting Micron, is simultaneously creating headwinds for other players further down the value chain. The interconnectedness of the tech supply chain means that a boom in one critical segment can create significant challenges for others.

The ultimate question for the industry, as posed by Partsinevelos, is whether these rising memory costs will start "slowing the AI infrastructure build-out or create margin pressure just across the entire supply chain." The answer likely lies in a combination of both. While the immediate demand for AI memory is strong enough to absorb current price hikes, sustained increases could force companies to re-evaluate investment timelines or seek alternative, potentially less performant, solutions. This dynamic underscores the strategic importance of memory in the AI era, positioning companies like Micron at a pivotal juncture in the technological landscape.