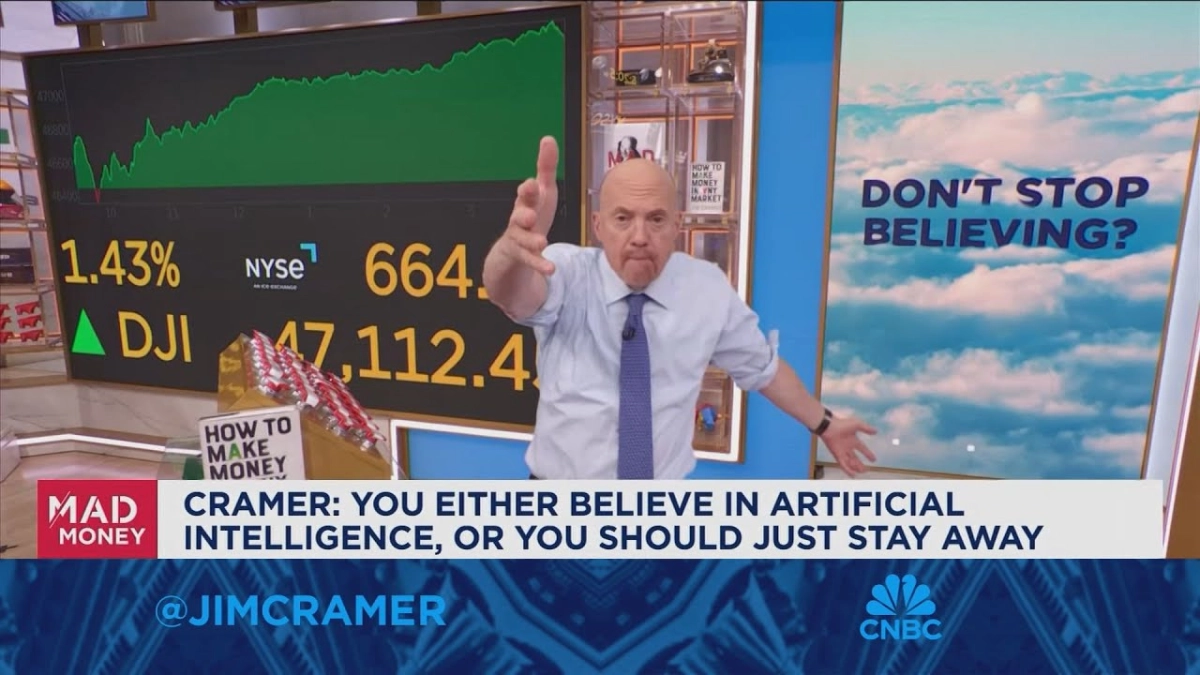

“You either believe or you don’t believe. It is as simple as that.” With this emphatic declaration, Jim Cramer, host of CNBC’s *Mad Money*, laid bare his bullish stance on the burgeoning artificial intelligence sector, directly addressing the skepticism surrounding the colossal investments made by tech giants. His commentary, following the significant announcement of a strategic partnership between OpenAI and Advanced Micro Devices (AMD), underscored a profound shift in the technological landscape, one he firmly believes heralds the Fourth Industrial Revolution.

Cramer's segment served as a direct response to the news that OpenAI would be deploying six gigawatts of AMD’s GPUs, a move that sent AMD's stock soaring by nearly 24% in a single session. This development, coming hot on the heels of a previous ten-gigawatt deal between OpenAI and NVIDIA, highlights a critical inflection point in the AI race. Cramer spoke with a palpable conviction, drawing parallels between the current AI boom and previous industrial transformations, while robustly defending the strategic rationale behind the hyperscalers' aggressive spending.

The core of Cramer’s argument rests on the idea that artificial intelligence is not merely an incremental technological advancement but a fundamental reshaping of industry and society. He recalled a conversation with NVIDIA CEO Jensen Huang in 2018, where Huang first articulated the vision of AI ushering in the Fourth Industrial Revolution. Cramer initially considered this "a little bit hyperbolic," but now, witnessing the current pace of innovation and investment, he is a firm believer. He outlined the preceding revolutions: the steam engine and machine production, electricity and mass production, and the digital era encompassing automated production, electronics, telecommunications, and the personal computer. Now, we stand at the precipice of an era defined by "artificial intelligence and machines that reason."

This perspective is crucial for understanding why Cramer dismisses the "countless AI skeptics" who draw comparisons to the dot-com bubble of 2000. These critics, he argues, see the massive capital outlays as reckless spending, transactions based on "alchemy," or "lazy Susan deals" where money is merely circulated without genuine value creation. Cramer takes strong exception to this narrative. He asserts that the current wave of investment is fundamentally different, driven by legitimate demand and genuine technological breakthroughs.

The OpenAI-AMD partnership is a testament to this demand. OpenAI’s co-founder and president, Greg Brockman, openly stated the company's need for "all the computing power he could get his hands on," finding AMD's product "excellent." This isn't a speculative venture; it's a necessity. The deal, which includes OpenAI receiving warrants for up to 160 million shares of AMD common stock as the GPUs are deployed, could be worth "tens of billions of dollars" to AMD, signifying a substantial, long-term commitment. The market's immediate positive reaction, with other data center players like Dell, ARM, Marvell, and Micron also seeing gains, further validates the broad-based belief in AI's transformative power.

Cramer's confidence extends to the leadership driving these companies. He trusts individuals like Sarah Friar, OpenAI’s CFO and a former managing director at Goldman Sachs, and Lisa Su, AMD’s brilliant CEO, both of whom he lauded for their "impeccable credentials." This stands in stark contrast to the dot-com era, which he characterized by "shysters and crooks and liars and mountebanks" at the helm. For Cramer, the integrity and proven track records of today's tech leaders differentiate this boom from past speculative frenzies.

The aggressive spending by hyperscalers like Meta, Tesla, Google, Microsoft, and Amazon is not, in Cramer's view, a sign of impending collapse. It is a strategic imperative. These giants are not worried about the cost of equipment becoming obsolete; they possess "very deep pockets" and are driven by a far more existential fear: "They're deathly afraid of someone else coming in to take their business." Each of these companies has critical verticals—social ads, robotics, search, enterprise, retail—that are increasingly dependent on advanced AI capabilities. To fall behind in this race means ceding market share, or worse, becoming irrelevant. They need "every bit of computing," including both NVIDIA and AMD's offerings, to maintain their competitive edge and push the boundaries of what's possible.

In essence, Cramer's message is clear: the current AI investment spree is a race for survival and dominance in a new industrial era. The scale of spending, far from being a red flag, reflects the immense stakes involved. The hyperscalers are investing not out of recklessness, but out of a calculated fear that if they don't, "OpenAI, or something like it, will eat their lunch." This strategic urgency, underpinned by credible leadership and tangible technological progress, paints a picture of a revolution in full swing, where aggressive investment is simply the cost of staying in the game.