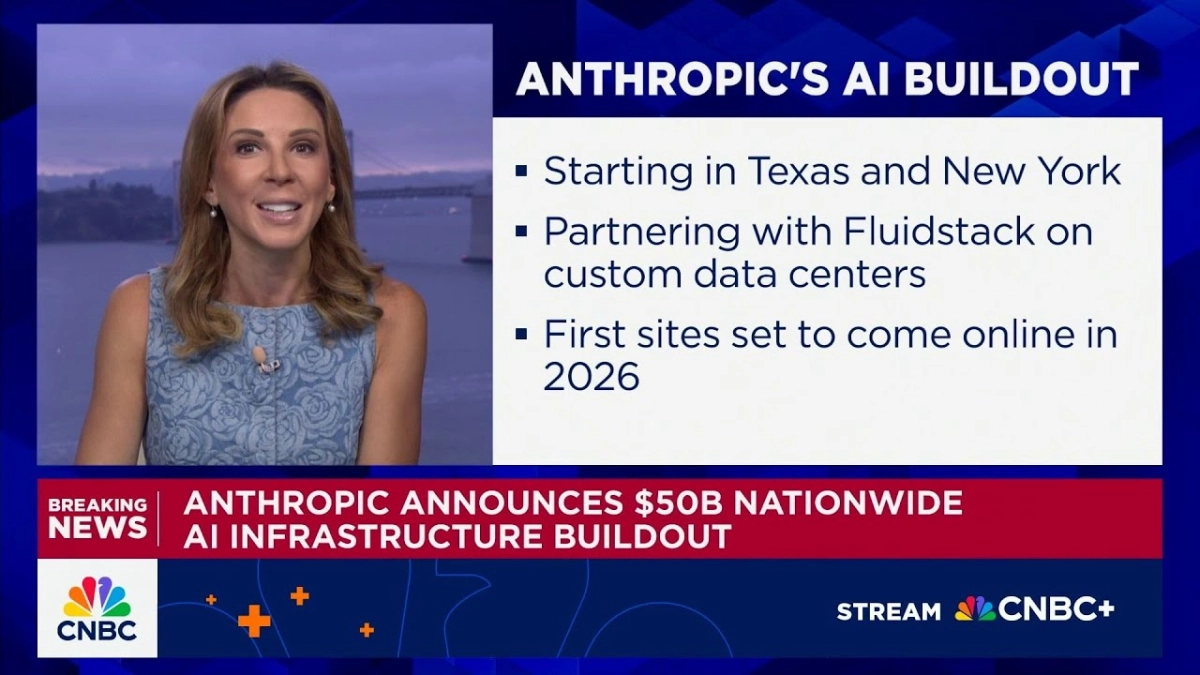

The race for artificial intelligence dominance is escalating, and Anthropic's recent announcement of a $50 billion nationwide AI infrastructure buildout signifies a monumental shift in how AI companies are planning for the future. CNBC's MacKenzie Sigalos reported on this ambitious undertaking, detailing Anthropic's strategy to construct custom data centers across the United States. This initiative, set to begin in Texas and New York with first sites online in 2026, is a direct response to the burgeoning demand for AI compute power, particularly for training and deploying large language models.

Anthropic is partnering with Fluidstack, a company specializing in building custom data centers capable of delivering gigawatt-scale power on aggressive timelines. This strategic alliance underscores the critical need for specialized infrastructure to support the ever-increasing computational requirements of advanced AI. The scale of this investment is unprecedented, positioning Anthropic to control a significant portion of its own AI hardware backbone, rather than solely relying on cloud providers. This move suggests a desire for greater control over performance, cost, and the specific hardware configurations needed for their proprietary AI models, which include those from Meta, Midjourney, and Mistral.

A key insight from this announcement is the vertical integration trend within the AI sector. As AI models become more complex and computationally intensive, companies are realizing the strategic advantage of owning and managing their own infrastructure. This allows for optimization of hardware, power consumption, and cooling, all of which are critical factors in the cost-effectiveness and efficiency of AI operations. By building its own data centers, Anthropic aims to circumvent the supply chain constraints and potential bottlenecks associated with relying on third-party cloud services, especially for acquiring the vast quantities of GPUs required.

The sheer magnitude of the $50 billion investment is striking, especially when contrasted with the financial realities of some AI startups. While Anthropic has secured substantial funding, including an $11 billion round from Amazon and a $4 billion round from Google, the question of how this massive infrastructure project will be financed remains pertinent. The report mentions that "internal projections show Anthropic expects to break even by 2028," a goal that this ambitious buildout will undoubtedly influence. The Wall Street Journal has reported on these projections, highlighting the company's focus on achieving profitability.

Another crucial aspect is the strategic selection of locations. Starting in Texas and New York suggests a focus on regions with robust power grids and potentially favorable regulatory environments for large-scale data center development. The choice of partners like Fluidstack, known for its ability to rapidly deploy custom data centers, is also telling. This indicates Anthropic's urgency in scaling its operations to meet immediate and future demand.

This infrastructure buildout directly addresses the immense computational needs of modern AI. As MacKenzie Sigalos stated, "This is really the clearest sign yet that Anthropic wants to control the physical backbone of AI, not just the models that run on top of it." This sentiment captures the core strategic shift Anthropic is undertaking. It signifies a move from a purely software-centric approach to a more holistic, hardware-inclusive strategy. This control over the physical infrastructure is becoming a significant competitive differentiator in the AI landscape.

The financial implications of such a large-scale project are considerable. While the video touches upon financing through debt and equity, it also alludes to the growing complexity of AI financing. The mention of "AI debt boom showing real signs of strain" and "Oracle's credit default swaps" suggests a broader market concern about the sustainability of massive AI investments. However, Anthropic's approach, leveraging NVIDIA GPUs as collateral for debt packages, demonstrates a creative approach to financing, aiming to secure the necessary capital for this ambitious expansion. This financial engineering highlights the innovative methods being employed to fund the AI infrastructure race.

The implications of Anthropic's announcement extend beyond its own operations. It signals a broader trend of major AI players investing heavily in physical infrastructure, potentially reshaping the competitive landscape and influencing the development of AI hardware and data center technologies. The race is on to secure compute, and Anthropic's $50 billion commitment is a powerful statement of intent.